2025 Roth Ira Contribution Limits Income - The contribution limit for individual retirement accounts (iras) for the 2025 tax year is $7,000. Best Brand Of Refrigerator 2025. Most and least reliable refrigerator brands. This samsung 189 l […]

The contribution limit for individual retirement accounts (iras) for the 2025 tax year is $7,000.

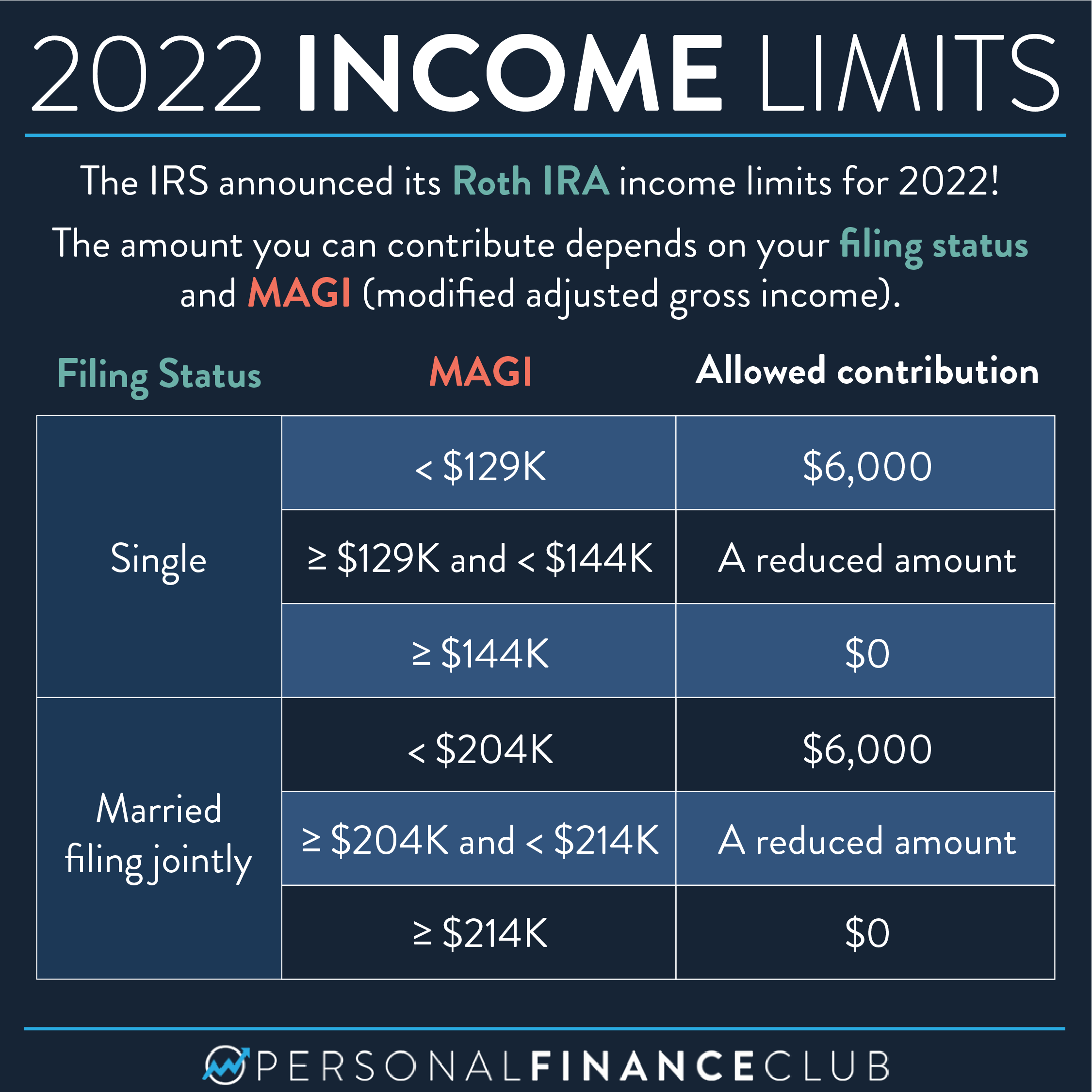

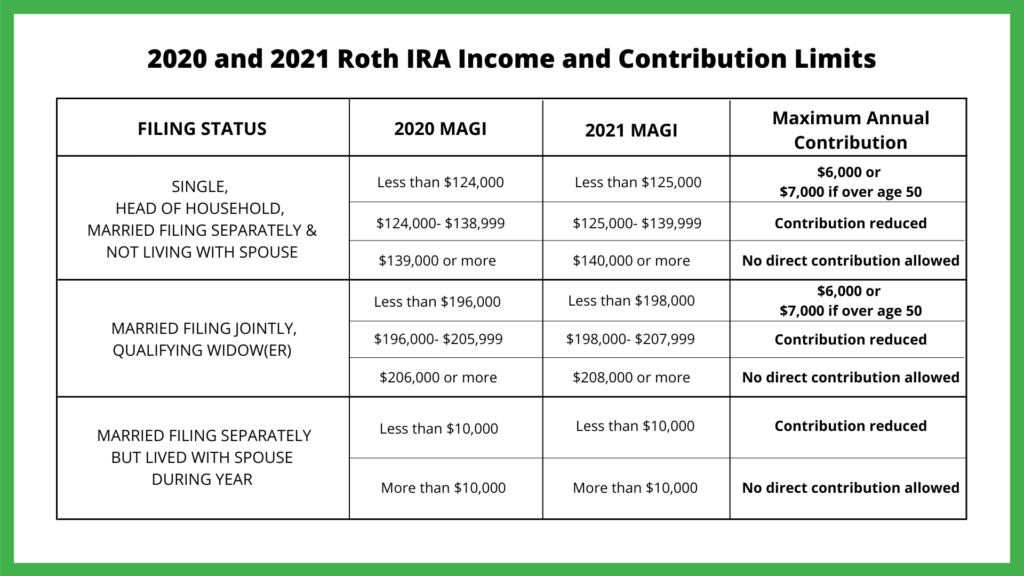

In addition to the general contribution limit that applies to both roth and traditional iras, your roth ira contribution may be limited based on your filing status and income.

If you’re a single filer, you’re eligible to contribute a portion of the full amount if your magi is $146,000 or more, but less than $161,000.

2025 Roth Ira Limits Joye Mahalia, And it’s also worth noting that this is a cumulative limit. As shown above, single individuals enter the partial.

2025 Roth Ira Contribution Limits Income. The roth ira contribution limit increases from $6,500 in 2023 to $7,000 in 2025. In 2025, this increases to $7,000 or $8,000 if you're age 50+.

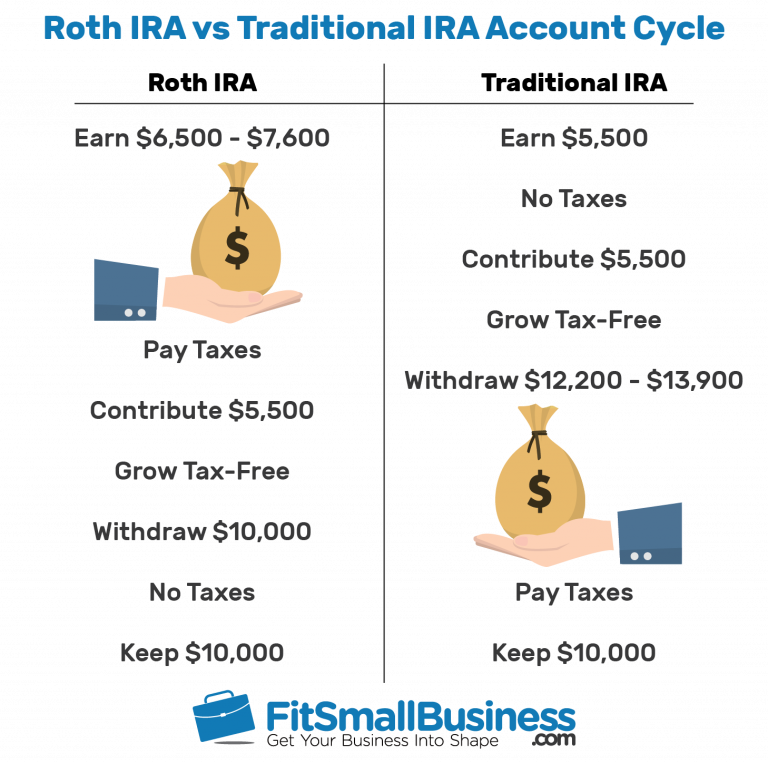

Backdoor Roth IRA's, What You Should Know Before You Convert Due, The contribution limit for a roth ira is $6,500 (or $7,500 if you are over 50) in 2023. This financial move could lead to a tax bill.

In 2025 you can contribute up to $7,000 or your taxable compensation.

Contribution Limits Increase for Tax Year 2025 For Traditional IRAs, The roth ira income limit to make a full contribution in 2025 is less than $146,000 for single filers, and less than $230,000 for those filing jointly. The roth ira contribution limit for 2025 is $7,000 for those under 50, and an additional $1,000 catch up contribution for those 50 and older.

Roth Ira Limits 2025 Nissa Estella, Roth ira contribution limits are set based on your modified gross. These same limits apply to traditional iras.

2025 Contribution Limits Announced by the IRS, *customers age 50 and older can contribute more to dcp annually. The contribution limit shown within parentheses is relevant to individuals age 50 and older.

New 2025 Ira Contribution Limits Phebe Brittani, *customers age 50 and older can contribute more to dcp annually. You're allowed to invest $7,000 (or $8,000 if you're 50 or older) in 2025.